As charter school leaders know well, managing your facility—whether you’re on the path to ownership or currently leasing—requires significant planning, collaboration, and foresight. In my work with schools across the country, I’ve seen how understanding your options, budgeting realistically, and negotiating strategically can transform your facility from a simple expense into a powerful investment in your school’s mission.

When Is Your School Ready for Property Ownership?

One of the most common questions I receive from school leaders is how to determine when they’re ready to transition from leasing to purchasing. Ideally, a school looking to purchase should demonstrate strong financial health, including:

- Stable or increasing enrollment, preferably with a waitlist

- Long-term charter renewal, indicating operational stability

- Several years of positive cash flow

- Adequate cash reserves for unforeseen expenses or building improvements

These factors signal to potential lenders that your school is a good investment risk. However, if your school doesn’t meet all these criteria, don’t be discouraged. There’s still a path to ownership—it may just look different or affect your timeline.

Funding Options Specifically for Charter Schools

Charter schools have access to several specialized funding options that can make facility ownership more accessible:

- Facility grants and programs like Charter School Facility Grant Programs that reimburse lease costs for schools serving low-income students (California’s SB 740 is one example)

- Federal charter school grant programs for replication or expansion

- Charter school bonds, which offer low-cost financing options ideal for larger, more established schools

- New Market Tax Credits that can reduce project costs by offering tax credits to investors (especially valuable for improvement or redevelopment projects)

- Mission-aligned lenders offering predevelopment, acquisition, and construction loans specifically to schools

- Philanthropic impact investors and foundations offering recoverable grants or low-interest loans

- Tax-exempt lease-to-purchase financing, which allows charter schools to lease a facility with either an option to buy or a clear path to ownership (this is what Grow Schools offers to charter schools)

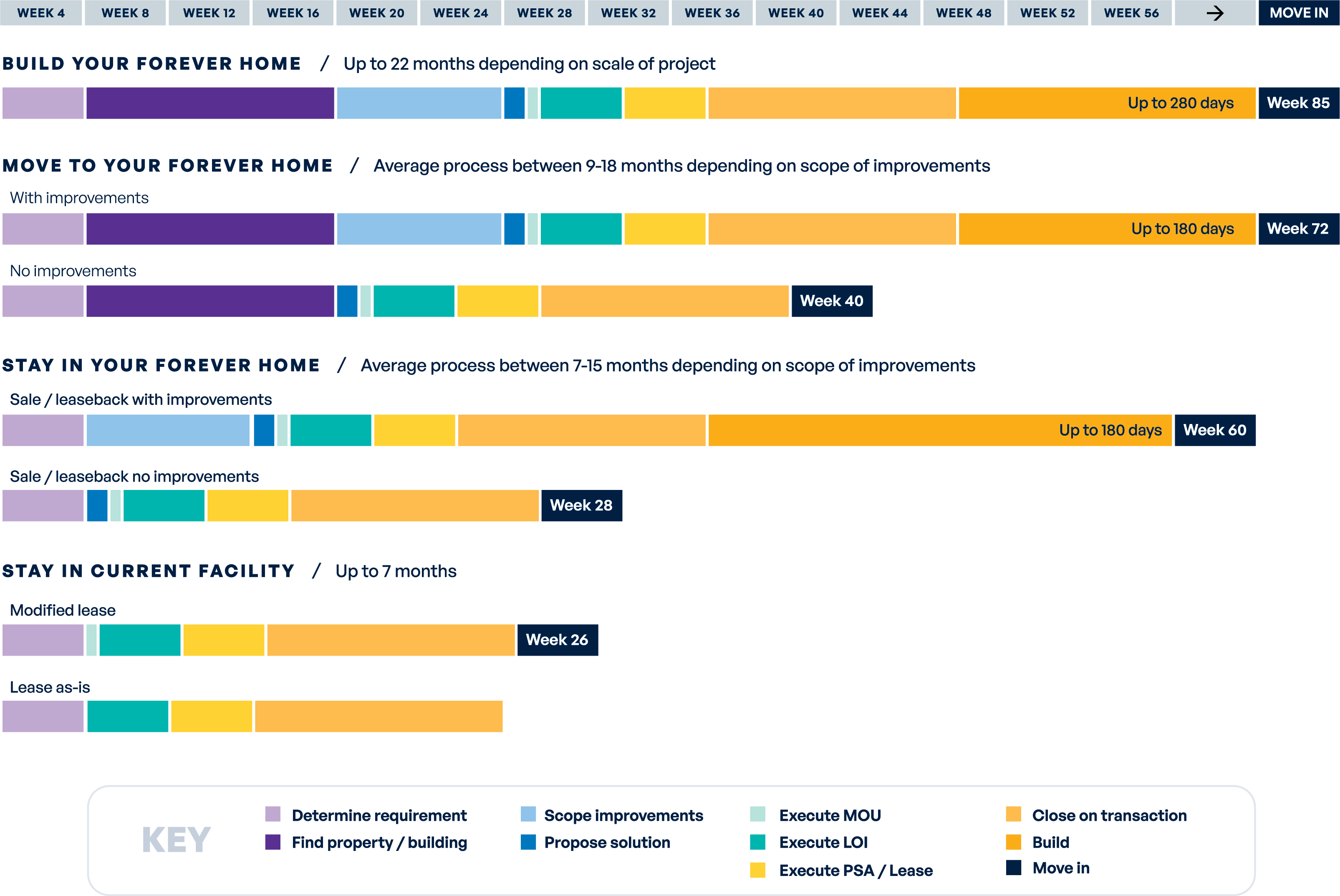

Understanding Project Timelines

It’s never too early to start planning for your facility needs. Different acquisition paths have varying timelines:

- Purchasing your current facility: 4-6 months (most straightforward)

- Locating and purchasing a new site: 12-18 months (depends on market inventory and whether conversion/improvements are needed)

- Purchasing land and developing a new facility: 18-24 months (most complex)

Always budget more time than you think you’ll need. Construction timelines frequently slip, and approval processes vary significantly by location.

Regardless of which path you choose, the acquisition process typically includes these key milestones:

- Strategic planning and feasibility to assess your facility needs and financing options

- Site search and due diligence, including touring properties, submitting offers, and conducting site feasibility studies

- Financing and entitlement periods, including financing applications, working with legal and real estate professionals, and navigating conditional use permit processes

- Closing and implementation, including finalizing financing, securing permits, and planning for build-out

Balancing Current Needs with Future Growth

Perhaps the most delicate balancing act in facility planning is addressing your immediate space needs while planning for future growth.

Here’s what you’ll want to consider:

- Right-size for today while planning for future expansion

- Avoid overextending your budget chasing a dream campus

- Look for properties that allow for phased growth, such as those with room for modular classrooms or phased construction

- Consider excess land that could accommodate future development

- Verify zoning and CUP flexibility to ensure the site allows for additional classrooms or facilities without significant reentitlement (which can be costly and time-consuming)

- Evaluate shared-use possibilities or temporary structures that can provide interim growth options

- Consider subleasing opportunities to supplement income while you grow into your space

- Prioritize location and transportation logistics, ensuring good long-term traffic flow and adequate space for drop-off and pickup logistics

Moving Forward with Confidence

Every school’s facility journey is unique, with its own challenges and opportunities. Whether you’re considering a move from leasing to ownership or looking to make your current facility work harder for your educational mission, the key is thoughtful planning and strategic timing.

By understanding your financial position, researching your options, giving yourself ample time, and balancing current needs with future vision, you can transform your facility from one of your biggest expenses into one of your most valuable assets—one that actively advances your educational mission and creates opportunities for your students and staff for years to come.

About the Author

Maddy Marlton is the VP of Real Estate Acquisitions at Grow Schools, where she helps schools optimize their facility financing to support long-term growth and sustainability.