Expert Advice on Accessing and Funding Charter School Facilities

Expert Advice on Accessing and Funding Charter School Facilities

In this CHARTER EDtalk, we sat down with Mike Morely, Founder and Principal at American Charter Development to talk about charter school facilities. Mike shares his years of experience in working with charter schools and supporting charter school success. Learn some insights on how to know when you’re ready for a new facility, what your funding options are, some pitfalls to avoid, and how to set yourself up for success whether building from the ground up or renovating your charter school facility.

Janet Johnson (JJ): Good day. This is Janet Johnson with Charter School Capital at the National Charter School Convention in Austin, Texas, and we’re honored today to be talking with Mike Morely with is ACD, who is a developer of charter schools.

Mike Morely (MM): That’s correct, yes.

JJ: John Dahlberg from Charter School Capital, and we’re going to have a conversation about charter school facilities. Take it away gents.

Jon Dahlberg (JD): Thank you. Hey Mike, thanks for making the time.

MM: My pleasure.

Why Charter Schools?

JD: We’re doing a campaign, We Love Charter Schools, can you share what you love about charter schools in less than 20 minutes.

MM: That may be hard, but I can sure try. You may know, in fact I know you know that we’ve got a large family. I come from 13 kids and have nine children of my own and so we’re into kids, and so we’re into whatever is good for kids. Several years ago I was in the legislature in Utah and was introduced to charter schools, didn’t really know much about them. A wise senator told me, as I was looking at that in terms of policy decision, that if parents can vote with their feet we’re going have a lot less administrative and regulatory needs for schools.

I got into charter schools, started looking at them, seeing that they were doing more with less, and in many cases outperforming schools that were run by districts with seemingly unlimited funds. Not obviously that, it is something that is debatable, but certainly on less funds that are being provided for district schools and being successful. We fell in love with the choice in education. We started a couple charter schools, started doing facilities for charter schools, and they were accepted well and been successful. My children, at least those that were growing up during the years that we were in charters schools and been in them, and we’ve been really pleased with the outcome. We love philosophically the choice option and we also are committed to providing that opportunity for others.

How to Know When You’re Ready for a New Facility

JD: That’s great. Well, so let’s take that to our listeners here. How do you know when a school is ready for a new facility?

MM: Well, we have been in the business of trying to help schools get facilities from the beginning, and we initially started back in the early 2000s trying to figure out how to bring construction and development funds into the charter school. Because obviously, it’s not available through state funding, they get funded based on the kids that they have in the seats. It’s kind of cart before the horse because they don’t have any kids in the seats when they’re starting out. We have funded schools from inception or even before inception and help them get their charters, help them establish a board, help them move through the process and having a school, a brand new school, ready for them to start in the first year.

Not all schools are able to do that, and it may not even be wise for all schools to do that. It really has a lot to do with the demand in the area, what the curriculum is going to be. I mean we’ve helped schools from project-based, sports, STEM and STEAM. We’ve helped classical education schools, and there are schools that are focused on a particular niche that may not be as widely accepted as maybe some other schools.

We look at the experience of a board. We like to see a wide diversity of experience on a board. We like to see the somebody that has accounting experience, marketing experience, legal experience business experience, school experience, but usually, that’s not the problem. Usually, most of them have good education experience, but we like to see a really diversified board with experts in many areas so that they can pull from that. We like to see some experience in the charter school world now. In the beginning not many had it, but now there’s usually good experience to be had on a board from the charter world. If we’ve got that, and we are comfortable with their curriculum, and their focus, and their direction, we may take them on right out of the chute.

If not, we like to see them have a year or two in maybe a rental facility, and it’s hard sometimes to find. But they may have to start out a little small and rent some space from a church, or some other local facility that’s not going to be maybe the best situation for the first year or two, but to build a little bit of a track record to see if they’re going to be successful. It really is ultimately a business and ultimately it’s pretty risky. We’ve had a few of those, as you know, that hasn’t been quite as stellar and so we’re trying to make sure that we don’t repeat those that are not quite as well prepared as others.

JD: Well, I think to the point about the risk, I think that proof of concept starting in any space where you can get your school open and get the kids coming and prove your operation of success and your academic success, that momentum builds and builds and creates opportunity in the future.

MM: It does.

Avoiding Mistakes

JD: When you talk about the business aspect of it, right? The education is not hard. What are some of the avoidable mistakes that a school should be mindful of as they’re building and growing in to their next facility project?

MM: You know, to be honest, most of the mistakes that we have seen have been very preventable and most of them have been friction within the board, within the founding boards. When the schools have the most trouble it’s typically when the board itself gets heavily in two separate directions and end up in a collision course with each other, and end up destroying what they created or trying to change direction from what was originally envisioned. Because of that they lose half the parents, they pick sides, and it becomes a disaster. Cohesiveness on board is really key and to avoid that they need good board training, they need to recognize what a board does, how a board operates and the way that a board should function with regard to the administration, and the product that they’re proving. They’re really providing an education product, and they need to be on board with that and need to understand how a board effectively is to run, so that’s been our biggest problem.

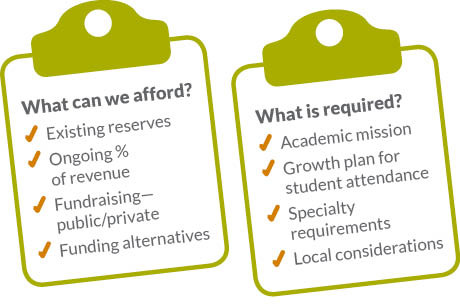

There are mistakes. They get into a building that doesn’t meet their needs, they get into a building that they didn’t really clearly think out what their program was or growth options. They could then be unable to grow in that position in that particular building and then be tied into either a long-term lease, or they purchased the building, and it isn’t suitable for their current needs or expanding needs. It’s really important that you really sit down with somebody that understands and lay out a long-term vision of the school.

Have the board be on board with that decision as well. Make sure that everybody is kind of firing with the same cylinders and moving in the right direction. Recognizing that, “Hey, we want to be a 400-student school forever. We want to grow to a K-12, or we’re going to stay at K-6, or we want to grow to 600.” Come up with what your ultimate vision is because if you’re in a place that can’t be expanded and you’re tapped out at 200 kids and you got a long-term commitment and you want to grow, you’ve contract yourself. Those are some concerns that need some-

JD: I think the advice that you gave to our audience about making sure that your building and your charter are in sync is really, really sound advice here. The building is going to create the culture of your school. We do speak with leaders who are very intentional, and we also speak with leaders who have that aha moment that goes, “Oh, a stem school but I don’t have a science lab.” That’s a good …

MM: A sports school and don’t have a gym or a …

JD: Right.

MM: … or a performing arts school and no place to perform. Yeah, those are a lot of the issues.

JD: If you’ve got a board that’s cast division and everybody’s on board, what are some of the guidelines and guiding principles that schools should pay attention to when they’re thinking about that next facility?

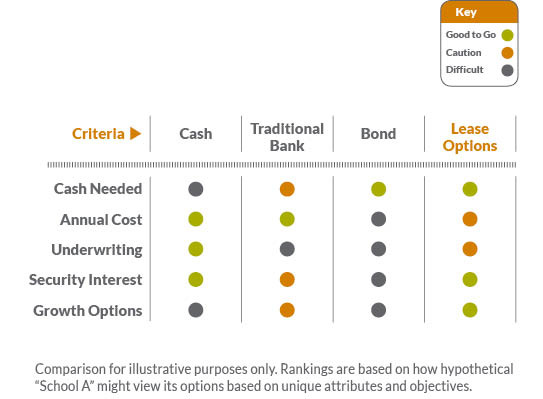

MM: Well, if everybody’s locked stamp, then I think it’s important to maybe look at what’s the most economical and formal way to provide those facilities. It always seems to be the vision of every school to bond. That’s the goal. We just come out of a situation not too long ago where the school was ready to bond, they were so excited about it. They were saying, “Hey the cost of this building is too high, we can’t really bond because we’re going to be paying $106,000 a month for our facility.” I said, “Whoa, what are you paying for it now?” In a lease scenario, they were paying $65,000 and they were expanding with the bond. They were going to add on a gymnasium and some other classroom, but we’d already priced that out, and under the lease scenario they were going to be at $85,000 a month with total expansion taken into account. I said, “Why are you so anxious to bond and pay $20,000 more a month for a facility that you can control and have long-term security for $85,000.” That was the A-ha moment.

“But their interest rate is lower than your PACT rate.” Okay, let’s look at that, what that means. Interest rates are easy to talk, but they were adding on several million dollars in reserves, they had the cost of issuance, they had attorneys fees that were building up this huge amount that they would have to bond and pay interest on. Then it was advertised rather than just an interest only, so by the time you take all that into account the interest rate of the bond had very little to do with the cost of the facility on a monthly basis. Be careful that you’re not misled by some arbitrary interest rate or some lost leader kind of thing, and becoming so consumed with owning the facility.

Ownership is great and there are some times when it is a good decision, but ultimately if you own it you really own it. You’re responsible for all of the future expansions, you’re responsible for whatever taxes or insurance or other things, and you may have those kinds of things in the lease agreement as well, but you’re amortizing the facility and the ultimate goal is to own it, and if it’s a 30-year bond you own it just in time to completely refurbish it and start over. I’m not saying ownership is not a good thing, but it’s not the only way to do it.

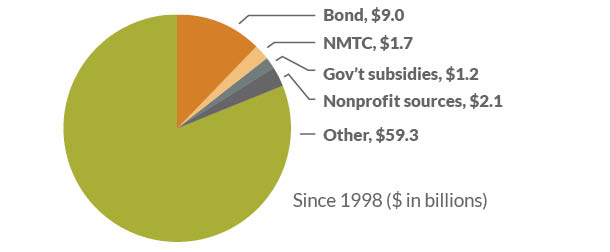

JD: What’s in the middle? There’s the bond, which historically meets the need of about 12% of the charter schools since the exception. Then we talk about the lease. You’re in the market, are there other options besides the lease or beside a bond that you’re seeing schools take advantage of right now?

MM: Well, you know, there are organizations like the CSC that have purchased facilities and leveled the lease market and created an option for schools. That we have worked together on a couple of schools where you would’ve been able to purchase the school and put them in a better position than they would’ve been in a bond situation. It’s an interesting dynamic because right now the cost of constructions is going up.

JD: And so is the cost of money.

MM: And so is the cost of money, which is hard. You got the cost of construction, cost of land skyrocketing in this market which is … The fed just raised the rates again last week, and so we’ve got interest rates going up. And they’re indicating that there will probably a couple more bumps, in trying to cool inflation. In a market where cost and money are going up even though we are seeing increases in education funding that are a much lower rate, you may get a two or three percent bump each year, while we’re seeing double digit increases in funding cost and in construction cost. We are in a kind of a paralysis market right now, and it is hard. We’re struggling to try and balance those things and make sure that schools are getting affordable facilities for themselves. It’s a bit of a challenge.

JJ: It’s a dance.

MM: It is.

JD: It’s a dance.

MM: We’re in that dance, and you’re in that dance, and we’re all trying to …

JD: It’s a fun place to be.

MM: It is.

JD: It’s work, because if it was easy they would call it a PTO.

MM: A while back it was kind of easy you know because the cost were fair. Right now, we’ve talked about this multiple times, there is a point where the school can’t pay any more than maybe 20% max of their gross revenue. If the cost of facilities goes beyond that then it really does make it difficult, if not impossible, for them to go for owning. There are places in the country like that.

JJ: But you’re here to help.

MM: We’re here to do what we can.

JJ: Right, yeah. That’s right. That’s great. Well, we’re very grateful for your time today Mike, and John thank you for facilitating this discussion and I know you guys speak a lot on the road so I’m sure that our viewers will see you again soon. Thanks for your time.

MM: You’re welcome. My pleasure, thank you for inviting me.

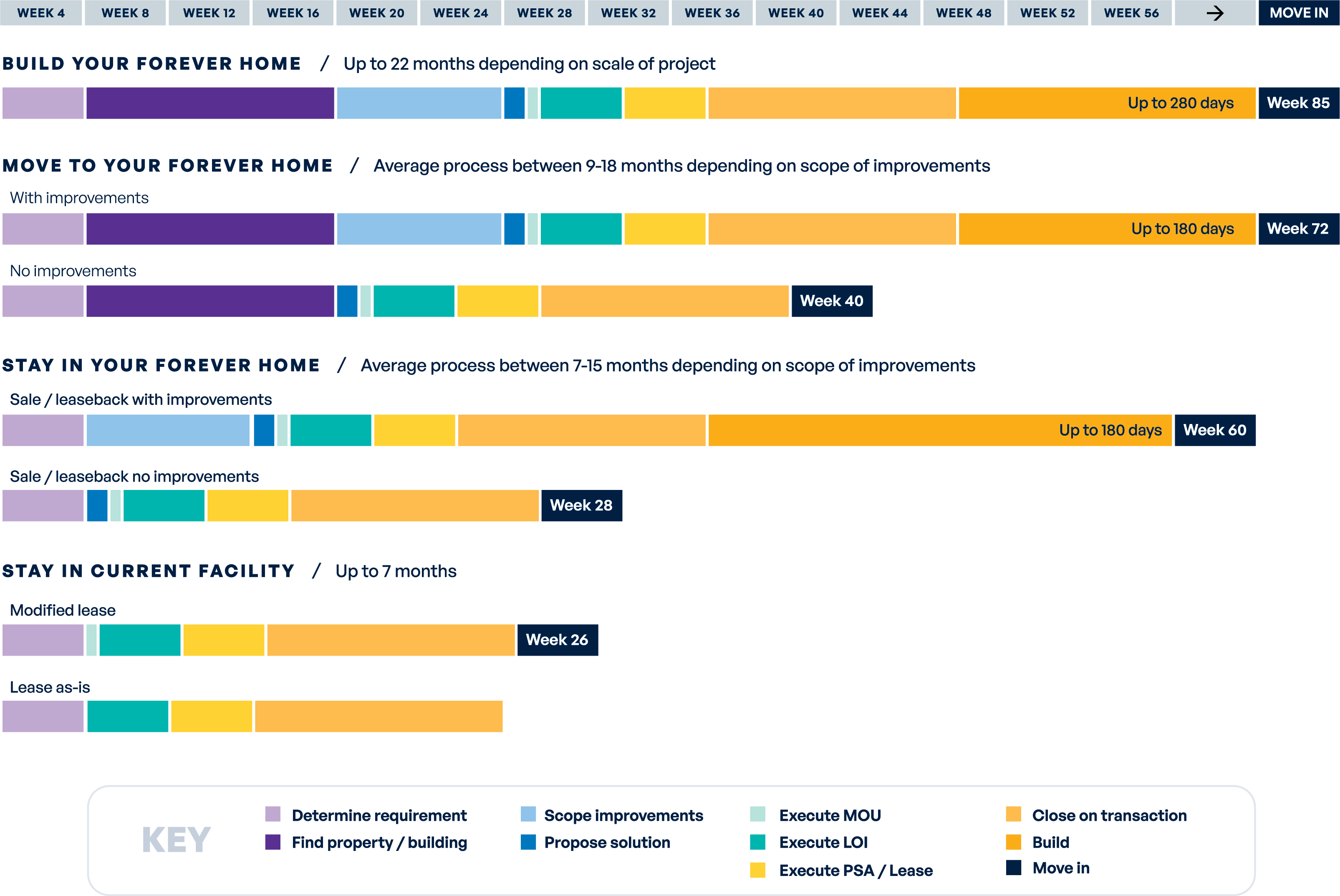

Plan – Begin planning at least one year in advance

Plan – Begin planning at least one year in advance