Best Practices for Charter School Facilities Financing

Best Practices for Charter School Facilities Financing

If you think charter school facilities financing can be a daunting task, you’re in good company. Most charter school leaders aren’t financial or real estate experts, and for a good reason—you’re focused 100% on educating children. If you’re reading this blog post, you probably feel like finding – and financing – the perfect facility for your charter school seems like a huge, complicated undertaking … you’re definitely not alone.

Across the U.S., facilities are, by far, the greatest challenge faced by charter schools. Planning and financing any facility project is complex, time-consuming, and has the potential to distract your team from its core mission: serving your students. We hope this post provides you with some best practices for planning and realistically balancing your team’s facility dreams with your budget realities, the pitfalls to avoid, financing options, and other key budgetary considerations.

Two Pitfalls to Avoid

Not Knowing Your Budget

Before you do anything else, understand what you can afford. Take the time to understand your revenue and expenses. Knowing what you can afford for rent will inform how much you can borrow for your new facility or facility expansion.

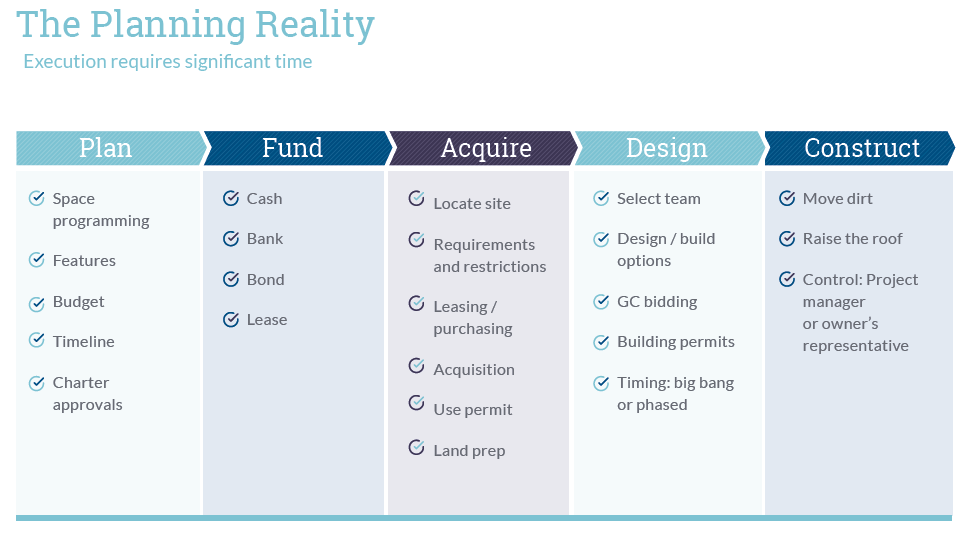

Not Planning Ahead

Plan at least a year ahead. Any kind of facility expansion will involve quite a lot of effort and likely involve your entire team. The range of burden varies, but moving staff, students, furniture, and equipment is an enormous undertaking. If you’re renovating your current facility, you still need to plan ahead so your programs aren’t disrupted.

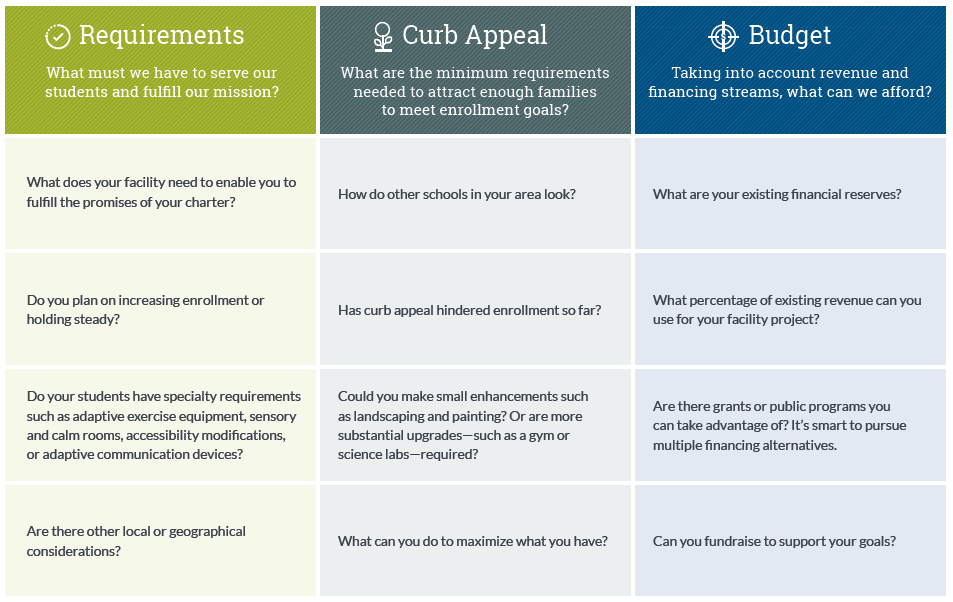

Three Budget Considerations: Requirements, Curb Appeal, Budget

When it comes to facilities, most charter schools are faced with a tough challenge: balancing essential requirements, aesthetics, and their budget.

It comes down to strategy: Is it more important to have enhanced facility options or invest in specific programs? If you have a top-tier robotics program, a new lab might be very important. If you’re offering an arts program, having an excellent sound dynamics room or a black box drama theater may be essential to your students’ performances.

Some key considerations:

Must-haves: What do you need to meet your mission?

Any special requirements? Are you running a dropout recovery program or a school for kids with developmental and learning disabilities? Do you need a state-of-the-art science lab or an air-conditioned gym to serve your students and mission?

Aesthetics: Does curb appeal affect enrollment at your school?

The way your school looks can have a significant impact on student enrollment, and enrollment drives operating revenue, which in turn affects the quality of your academic programs. Also, take a look at your competition. If every other school in your area is shiny and beautiful, but yours looks dilapidated and your enrollment is suffering, you may need to invest in improving your curb appeal.

Budget: What can you afford?

Getting prequalified is the key first step in the process of renovating, expanding, or finding a new facility. When pre-qualifying a school, a financial institution will look at a variety of factors, including:

- The school’s existing reserves

- Public subsidies

- Private donations

- Public or private foundation grants

- Operating revenue

- Charter term—financial institutions want to see that your charter has been renewed for the long-term

A Guide to Four Types of Financing

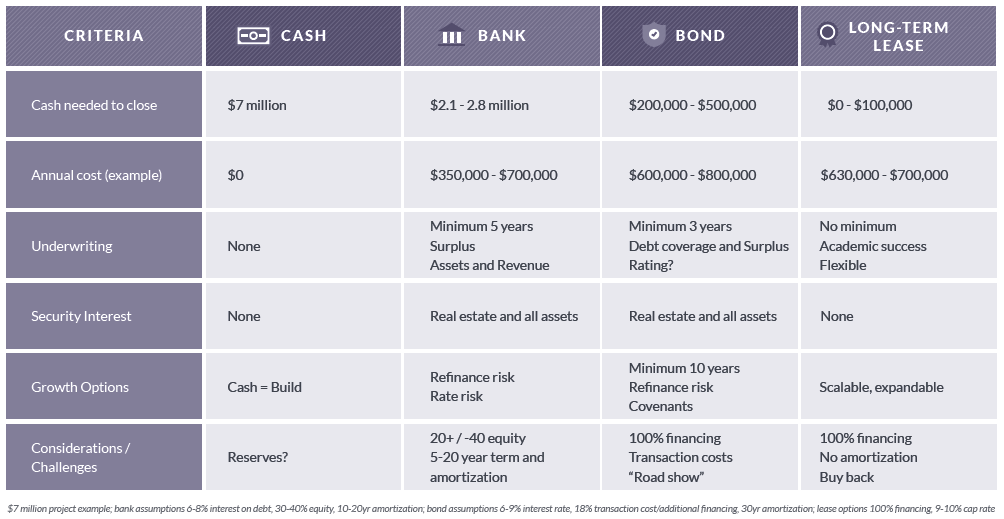

Cash

For most, paying 100% cash for charter school facility financing isn’t an option. And even if a school were to have significant cash reserves, it still may not be in their best interest to use it. On one hand, the school wouldn’t be on the hook for interest payments nor would it have to provide collateral, meet underwriting requirements, or undergo time-consuming approval processes. On the other hand, again for most, it would mean that the school’s cash reserves would take a major hit—and that’s money that might be more usefully deployed elsewhere. It could be used, for example, to hire more teachers, buy computers, or reinvest in academic programs.

Investment Banks

For stable and mature-stage schools that have plentiful cash reserves, this can be a great option for undertaking a $7 million facilities project without wiping out the savings account. Expect the underwriting process to be thorough and time-consuming—the bank will want to make sure that your school is stable and will still be around decades from now.

Bonds

In our experience, many charter schools have their sights set on a bond, believing it to be the most advantageous and common funding structure. The reality is that just 12% of charter schools nationwide receive bond market financing; the other 88% of charter schools rely on other funding methods. As with bank financing, the underwriting for bonds is time-consuming and involved, especially if a school has been operating for a short period of time or is waiting for a charter to be renewed. Unlike a bank loan, bonds don’t require a major up-front cash investment. However, bonds can become surprisingly costly, even with low interest rates, because it can take time for a school to accrue the cash reserves they are required to have in the bank for taxes and for the security of the bondholders. All the while, the school continues to pay interest. In addition, bonds usually require an outlay of hundreds of thousands of dollars in legal fees for each party’s attorneys in a (highly complex) transaction. For more clarity, check out this short video on when – and why – to select bond financing.

Long-Term Leases

Many schools begin with a long-term lease and then transition to a bond or a bank transaction after they’ve achieved stable revenue and enrollment. Long-term leases generally require relatively little cash up front. The cost of long-term leases vary based on location and are ultimately spelled out by the terms of the lease, but they can be relatively affordable, especially for newer, smaller schools. The underwriting requirements for a long-term lease are less involved than for a bond or bank transaction, though your board, charter, curriculum, and demographics will be reviewed in detail. No security interest or collateral is required because the landlord owns the building and the land, and the school simply rents it and supplies its own furniture and equipment. That means future operating revenues aren’t held as security interest as they would with a bond or bank transaction. As a result, a school can often get financing for furniture and equipment, which may not be an option with bond or bank financing. Click here to learn more about our long-term lease financing option.

How Experience and Charter Status Affect Your Options

Investors tend to prefer experienced charter schools that have shown that they have stable enrollments, predictable revenues, and good relationships with their authorizers. The first charter renewal is a crucial milestone. If you’re still in the first period of your charter, and your authorizer has not confirmed your success by renewing your charter and extending it for another five or 15 years, investors will consider your school to be a riskier proposition than those who have done so.

Options for Startup Schools

- Short-Term Lease: Startup charter schools with budgets of less than $7 – $10 million and in the first period of a charter will typically begin with a short-term lease. Many schools start out by leasing office space, the basement of a church, or an unused public school.

- Long-Term Lease: Long-term lease options are also available to new charter schools. For example, Charter School Capital and other institutions are now offering 20 – 40-year leases to schools, including to promising, sustainable schools that have not yet had their first charter renewal. A long-term lease can give even early-stage and high-growth schools control over their facility as well as predictable monthly costs—removing the worry of rising interest rates or surprise rent increases.

- Partnering with a Developer: Some developers specialize in charter schools and will consider working with very early-stage schools, even those that haven’t opened their doors yet. They have the expertise to build schools from the ground up or to completely renovate an existing building. Developers like working with schools if the management team has an excellent track record or are part of an expansion program for a charter management organization (CMO) or an education management organization (EMO). In this case, the developer accepts a high level of risk in order to invest in an early-stage school that most investors wouldn’t consider because they are working with people who also really understand the charter school market.

Options for Later-Growth or Mature Schools

- Bonds: Most schools aspire to own their facility, often through raising a bond—an arduous, expensive, and time-consuming process. A bond can be a great option for mature schools that are done expanding and are ready to move into their dream facility and forever home, with no further goals to expand beyond it. Bonds are typically issued for 30-year periods, and if structured properly, the rates can be attractive. For large transactions ($20 million plus), high legal expenses, brokerage fees, and transaction costs are spread over many years. Remember, bond brokers usually aren’t motivated for deals of less than $10 million. And because bonds are issued for the specific cost of a specific facility, they don’t make sense financially if you’re planning on expanding. In that case, you would have to find yet another funding source, while still maintaining your obligations to bondholders.

- Banks: For schools with sustainable operations, equity, and cash reserves, bank financing becomes a viable option. As we’ve noted before, banks typically require charter schools to contribute around a third of the transaction (anywhere from 20% – 40%) as equity—which is a significant barrier for many schools. On the upside, the transaction costs are often lower than those for a bond.

- Long-Term Leases: Just as with earlier-stage schools, long-term leases can be a highly efficient, reliable option for mature schools. Unlike bank transactions, leases don’t require a major outlay of cash for equity or the time, energy, and attorney fees associated with bonds. With a long-term lease, a school controls its property without the responsibility of investing in and owning real estate.

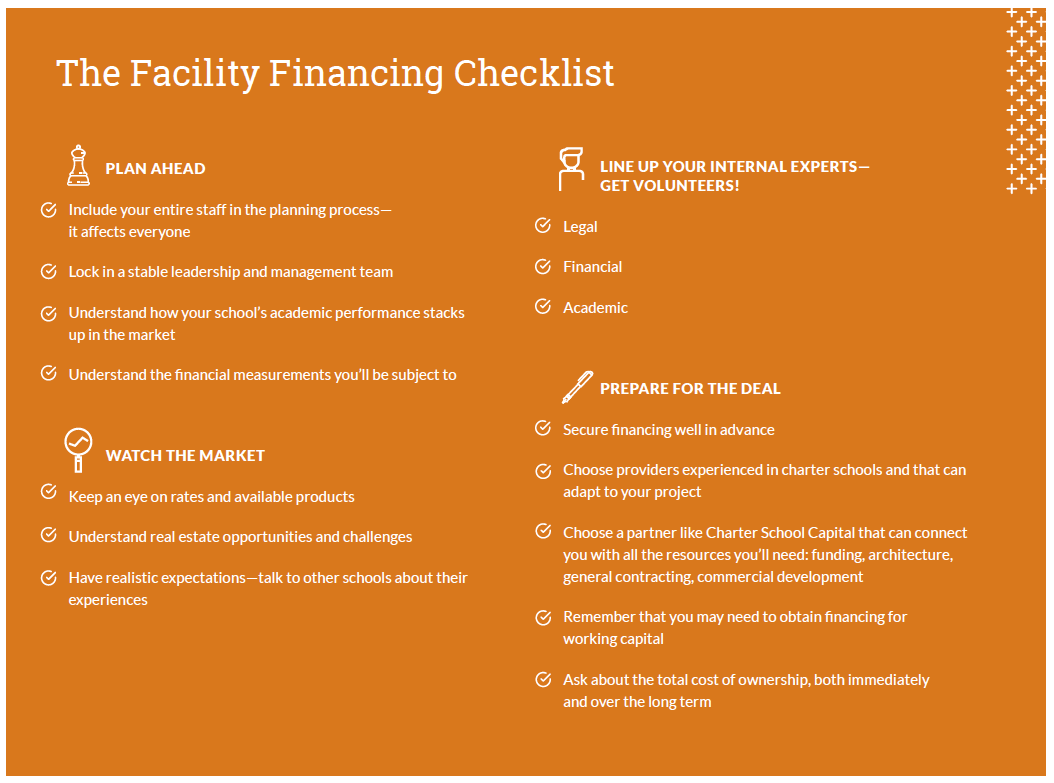

Four Key Factors for Funding Approval

- Sustainable enrollment: This is a key indication that a charter school will be sustainable over a long term. Prospective enrollment can be gauged by several metrics: current enrollment, a waiting list, and demand for charter schools in the local market. If a school is currently below target enrollment, financial partners will want to see that the wait list aligns with your enrollment targets. If you currently have 200 students and you want to be at 800, but there are only 250 kids on your charter, that will raise serious questions.

- Strong leadership: Financial partners want to see a strength of experience behind the leadership team, the management team, or the school itself. Investors may be happy to fund a startup school if the leadership team has already led other schools to sustainable success. A rookie management team will have a harder time obtaining investors.

- Sound financials: Financial partners will want to see that your debt obligations or lease payments are less than 20% of your operating revenue and that the cost of the property is consistent with property values in the local market. You have to be able to show you’ll be able to make payments over the length of the loan, bond period, or lease while still funding a quality academic program and breaking even or achieving a surplus.

- Good governance: For charter schools, that means having a stellar relationship with your authorizer. Investors will talk to the authorizer to ensure that they’re happy with your progress and have no hesitations about renewing your charter.

To download the PDF: The Ultimate Guide to Charter School Facility Financing, click here.

It’s important to find the right funding partner to help guide you through the facility planning and funding process … and help you succeed. Charter School Capital has years of experience in navigating the unique needs and challenges of charter schools and has helped schools achieve their facility goals using each of those methods—and we’ll help you see which options might be best for your school’s situation.

At Charter School Capital, we believe in the power of charter schools—and their leaders—to deliver quality education and foster success in their students. Over the past ten years, we’ve invested almost $2 billion in more than 600 charter schools to help them grow their schools, finance facilities, and achieve academic excellence and operational stability. We view ourselves as a longterm partner of charter schools and a strong advocate of the charter school movement. Please contact us if you’d like to learn more.