Navigating the Most Complex Challenge Facing Charter Schools Today

Charter school facilities financing represents the single greatest challenge facing educational leaders across the United States. While your expertise lies in education—not real estate or finance—securing the right facility at the right price is critical to your school’s success and your students’ futures.

This comprehensive guide breaks down everything you need to know about facilities financing, from initial planning through final approval, helping you make informed decisions that align with both your educational mission and financial realities.

Why Charter School Facilities Financing Is So Challenging

Unlike traditional public schools that receive taxpayer-funded facilities, charter schools must navigate the complex world of private real estate markets and commercial financing. This fundamental difference creates unique challenges that can distract leadership teams from their core mission of educating students.

The facilities challenge extends beyond just finding space—it involves balancing educational requirements, aesthetic considerations, budget constraints, and long-term strategic planning while maintaining focus on academic excellence.

Critical Pitfalls That Derail Charter School Facilities Projects

Pitfall #1: Not Understanding Your True Budget

Before exploring any facility options, you must have a clear understanding of your financial capacity. This means conducting a thorough analysis of your revenue streams and existing expenses to determine realistic parameters for facility investments.

Essential Budget Analysis Steps:

- Calculate current monthly operating expenses

- Project future enrollment and revenue growth

- Determine maximum affordable monthly facility payments

- Account for one-time costs like moving, renovations, and equipment

- Maintain adequate cash reserves for operational stability

Understanding your budget limitations early prevents costly mistakes and ensures you focus on realistic facility options that won’t compromise your educational programs.

Pitfall #2: Inadequate Planning Timelines

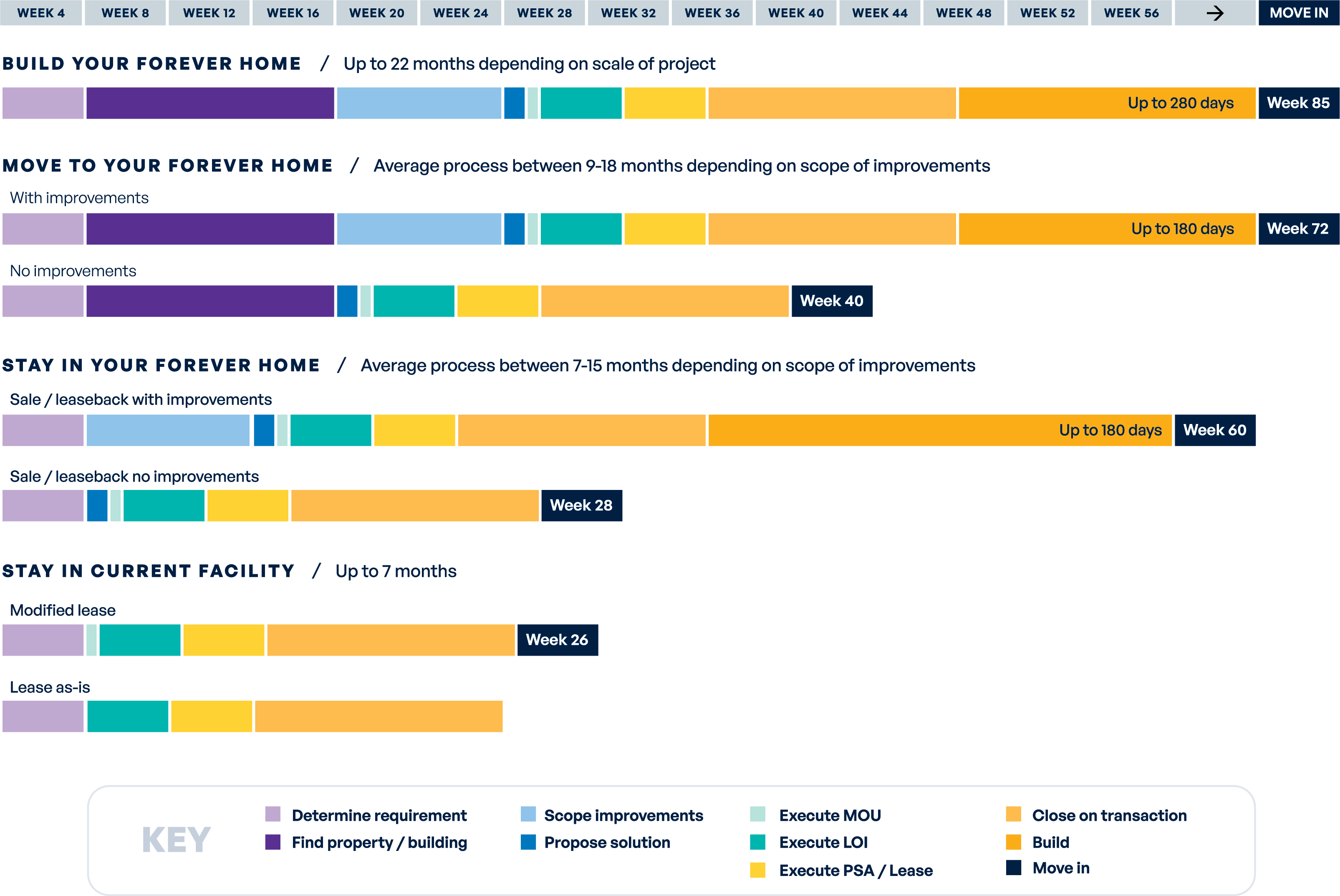

Facility projects require extensive advance planning—typically a minimum of 12 months for any significant expansion or relocation. The complexity of these undertakings affects your entire organization, from administrative staff to teachers and students.

Why Extended Planning Is Essential:

- Legal and regulatory approval processes take time

- Renovation and construction projects often face delays

- Staff and student transitions require careful coordination

- Furniture, equipment, and technology installations need scheduling

- Program continuity must be maintained throughout transitions

Schools that underestimate these timelines often face rushed decisions, cost overruns, and disruptions to their educational programs.

The Strategic Triangle: Requirements, Aesthetics, and Budget

Successful charter school facilities decisions require balancing three critical factors that often compete with each other.

Educational Requirements: Mission-Critical Needs

Your facility must support your specific educational approach and student population. Different school models have vastly different space requirements.

Questions to Consider:

- What specialized spaces does your educational program require?

- Do you need state-of-the-art science laboratories for a STEM focus?

- Does your arts program require performance spaces with specific acoustics?

- Are you serving students with special needs requiring specialized accommodations?

- Do you offer dropout recovery programs needing flexible classroom configurations?

Aesthetic Considerations: The Enrollment Impact

Your facility’s appearance directly affects enrollment, which drives the operating revenue that funds your academic programs. In competitive markets, aesthetics can make or break enrollment success.

Aesthetic Impact Factors:

- First impressions for prospective families during tours

- Competitive landscape—how does your facility compare to alternatives?

- Community expectations and demographics

- Impact on student pride and school culture

- Long-term brand positioning in your market

Budget Reality: What You Can Actually Afford

Financial sustainability must guide all facility decisions. Even the most educationally perfect facility becomes a liability if it strains your budget beyond sustainable limits.

Pre-Qualification Process: Financial institutions evaluate multiple factors when determining your borrowing capacity:

- Existing cash reserves and financial stability

- Current and projected operating revenue

- Charter renewal status and term length

- Public subsidies and private funding sources

- Grant opportunities and foundation support

Comprehensive Guide to Charter School Financing Options

Option 1: Cash Financing

Pros:

- No interest payments or ongoing debt obligations

- Complete ownership and control over the property

- No collateral requirements or underwriting processes

- Faster transaction completion

Cons:

- Depletes cash reserves that could fund educational programs

- Limits financial flexibility for unexpected needs

- Opportunity cost—funds could generate returns elsewhere

- Not feasible for most charter schools

Best For: Well-established schools with substantial reserves considering smaller facility investments.

Option 2: Investment Bank Financing

Overview: Traditional bank loans for charter school facilities typically require significant equity contributions and extensive underwriting processes.

Requirements:

- Typically 20-40% equity contribution from the school

- Demonstrated financial stability and enrollment trends

- Strong leadership team with proven track record

- Comprehensive business plan and financial projections

Pros:

- Lower transaction costs compared to bond financing

- More flexible terms than bond structures

- Builds equity ownership over time

Cons:

- Substantial upfront cash requirement

- Extensive underwriting and approval process

- Personal guarantees may be required

- Limited availability for newer schools

Best For: Mature schools with substantial cash reserves undertaking major facility projects ($7+ million).

Option 3: Bond Financing

Reality Check: While many charter schools aspire to bond financing, only 12% of charter schools nationwide actually secure bond market funding. The remaining 88% rely on alternative financing methods.

Bond Financing Process:

- Extremely thorough underwriting process

- Hundreds of thousands in legal fees per transaction

- Requires maintaining cash reserves for taxes and bondholder security

- Typically 30-year terms with fixed costs

Pros:

- No major upfront cash investment required

- Potentially attractive interest rates for large projects

- Fixed long-term costs provide budget predictability

Cons:

- Complex, time-consuming approval process

- Substantial legal and transaction costs

- Ongoing compliance and reporting requirements

- Reserved for larger transactions ($10+ million minimum)

- Requires continued interest payments during cash accumulation period

Best For: Large, stable schools ready for permanent “forever home” facilities with no expansion plans.

Option 4: Long-Term Lease Financing

Overview: Long-term leases offer many benefits of ownership without the capital requirements and risks of property ownership.

Typical Structure:

- 20-40 year lease terms available

- Minimal upfront cash requirements

- School maintains operational control

- Landlord retains property ownership and maintenance responsibilities

Pros:

- Low initial capital requirements

- Predictable monthly costs over lease term

- Less complex underwriting than bonds or bank loans

- Allows financing for furniture and equipment

- Future operating revenues not held as collateral

- Available to schools at various maturity stages

Cons:

- No equity building over time

- Potential rent escalations based on lease terms

- Less control over major property modifications

Best For: Schools at any stage seeking facility control with minimal upfront investment and predictable costs.

Four Critical Factors for Financing Approval

1. Sustainable Enrollment Patterns

What Lenders Evaluate:

- Current enrollment compared to charter capacity

- Historical enrollment trends and stability

- Waiting list size and demographic alignment

- Local market demand for charter options

- Competition analysis and market positioning

Red Flags for Lenders:

- Enrollment significantly below projections

- Declining enrollment trends over multiple years

- Waiting lists that don’t support expansion plans

- Oversaturated local charter market

2. Strong Leadership Team

Leadership Factors Lenders Consider:

- Previous experience successfully operating schools

- Educational leadership credentials and track record

- Financial management experience

- Board composition and governance experience

- Organizational management depth

How to Strengthen Your Leadership Profile:

- Document previous successes and achievements

- Highlight relevant experience in education and management

- Demonstrate board expertise and engagement

- Show succession planning and organizational depth

3. Sound Financial Management

Financial Health Indicators:

- Debt service coverage ratios above minimum thresholds

- Operating margins that support debt payments

- Facility costs representing less than 20% of operating revenue

- Strong internal financial controls and reporting

- Appropriate cash reserves for operational stability

Financial Documentation Requirements:

- Multi-year audited financial statements

- Current year budget and financial projections

- Cash flow analysis and debt service projections

- Enrollment and revenue modeling

- Expense management and cost control evidence

4. Excellent Governance and Authorizer Relations

Governance Evaluation Criteria:

- Board composition, experience, and engagement

- Compliance with charter requirements and state regulations

- Financial oversight and audit processes

- Academic performance and accountability measures

- Community relations and stakeholder engagement

Authorizer Relationship Assessment:

- Charter renewal history and prospects

- Compliance with authorizer requirements

- Academic performance relative to authorizer expectations

- Financial management and reporting quality

- Communication and collaboration effectiveness

Strategic Planning for Long-Term Success

Aligning Facilities with Educational Vision

Your facility should support and enhance your educational approach rather than constrain it. Consider how different spaces can:

- Support innovative teaching methodologies

- Accommodate diverse learning styles and needs

- Enable collaborative and project-based learning

- Provide flexibility for program evolution

- Create positive school culture and community

Financial Sustainability Beyond Initial Financing

Ongoing Facility Considerations:

- Maintenance and repair costs over time

- Utility expenses and efficiency improvements

- Technology infrastructure and upgrades

- ADA compliance and accessibility requirements

- Future expansion or modification needs

Building Community Support

Strong community relationships can provide additional resources and support for facility initiatives:

- Parent and family volunteer assistance

- Local business partnerships and support

- Community foundation grants and donations

- Municipal cooperation and assistance

- Neighborhood integration and support

Next Steps: Moving from Planning to Action

Immediate Action Items

- Complete Comprehensive Budget Analysis: Determine your realistic facility investment capacity

- Assess Current and Future Educational Needs: Define space requirements that support your mission

- Evaluate Market Conditions: Research available properties and competitive landscape

- Strengthen Financial Position: Build cash reserves and improve operational efficiency

- Engage Professional Support: Connect with experienced charter school facilities specialists

Building Your Facilities Team

Successful facilities projects require expertise beyond your educational leadership team:

- Commercial Real Estate Professionals familiar with educational requirements

- Architecture and Construction Specialists experienced with charter schools

- Financial Advisors knowledgeable about charter school financing options

- Legal Counsel specializing in educational and real estate transactions

- Project Management Support to coordinate complex timelines and processes

Conclusion: Making Informed Facilities Decisions

Charter school facilities financing doesn’t have to derail your educational mission. With proper planning, realistic budgeting, and the right financing approach for your school’s stage and circumstances, you can secure facilities that support excellent education while maintaining financial sustainability.

The key is starting early, understanding your options, and choosing financing approaches that align with your long-term educational and financial goals. Whether you’re a startup school seeking your first permanent home or an established school ready for expansion, the right facilities financing solution can enhance your ability to serve students and strengthen your community.

Ready to explore charter school facilities financing options? Our team specializes in helping charter schools navigate complex facilities decisions and secure financing that supports long-term educational success. Contact us to discuss your specific needs and explore solutions tailored to your school’s unique circumstances.